What is the interest rate for a quick online M-Pesa loan?

Interest rates play a pivotal role in the realm of quick online M-Pesa loans. FairKash+ stands out as a leading platform in Kenya, offering rapid financial assistance. Let’s delve into understanding the interest rates associated with FairKash+ loans.

Interest Rate Structure:

-

Variable Interest Rates:

-

FairKash+ offers flexible interest rates that might vary based on several factors, including the loan amount, repayment tenure, and the borrower’s creditworthiness.

-

Competitive Rates:

-

FairKash+ strives to maintain competitive interest rates within the lending market to ensure affordability for borrowers.

-

Transparent Fee Structure:

-

FairKash+ emphasizes transparency, providing borrowers with a clear fee structure outlining interest rates and any associated fees. This transparency helps users make informed borrowing decisions.

Factors Influencing Interest Rates:

-

Loan Amount:

-

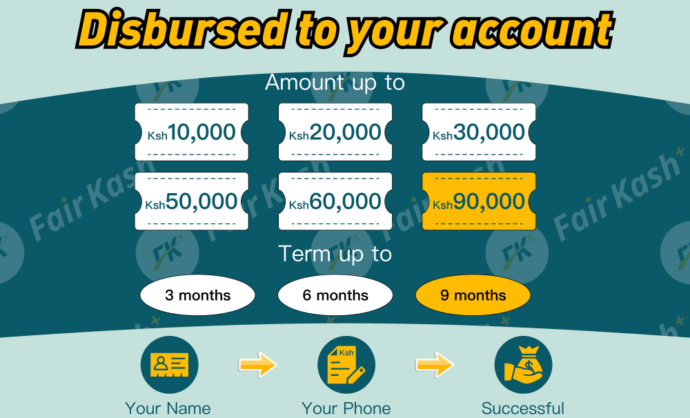

The interest rate might vary based on the loan amount requested. Higher loan amounts might incur different interest rates compared to smaller loans.

-

Repayment Tenure:

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

The duration for which the loan is taken might impact the interest rate. Longer tenures could have different interest rates compared to shorter ones.

-

Borrower’s Credit Profile:

-

FairKash+ might consider the borrower’s credit history and financial stability while determining the interest rate. Those with a robust credit profile might secure more favorable rates.

Importance of Interest Rates:

-

Cost Evaluation: Understanding the interest rates helps borrowers evaluate the cost of borrowing and make informed decisions.

-

Affordability Assessment: Knowing the interest rates allows borrowers to assess whether the loan aligns with their financial capabilities.

FairKash+ Commitment to Fairness:

FairKash+ is committed to providing fair and competitive interest rates, prioritizing transparency and affordability. The platform ensures that borrowers are aware of the rates and associated costs upfront.

The interest rates for quick online M-Pesa loans with FairKash+ vary based on multiple factors. Borrowers must thoroughly understand these rates and their implications before availing themselves of a loan. FairKash+ stands by its commitment to offering transparent and competitive interest rates, ensuring a seamless borrowing experience.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status