Which are the legit loan apps in Kenya?

Erick Yang

August 15, 2023

In Kenya, the rise of technology has transformed the way people access financial services, including loans. Numerous loan apps have emerged, offering individuals quick and convenient access to funds for various purposes. However, it’s important to distinguish between legitimate and potentially risky loan apps. Here, we’ll explore some of the legit loan apps in Kenya, focusing on FairKash+ as a standout example.

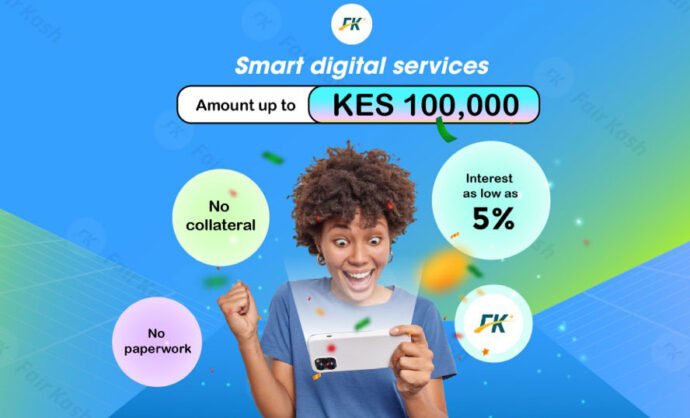

FairKash+

FairKash+ is a reputable and legitimate loan app that has gained popularity for its seamless lending process and commitment to customer security. With FairKash+, Kenyans can apply for loans directly from their mobile phones, eliminating the need for extensive paperwork and lengthy approval times. The app follows a straightforward application process, quick credit evaluation, and efficient fund disbursement, ensuring borrowers can address their financial needs promptly.

FairKash+ stands out due to its transparent terms, reasonable interest rates, and responsible lending practices. Borrowers can choose from various loan amounts and repayment options based on their preferences and financial capacity. The app’s dedication to safeguarding customer information and maintaining data privacy has contributed to its positive reputation as a legit loan app in Kenya.

How to Apply for a Loan on FairKash+

-

Download and Register: Download the FairKash+ mobile application on your device and complete the registration process. Provide basic personal information such as name, phone number, and email address to create an account.

-

Fill Out the Loan Application: After logging into your FairKash+ account, you will find the loan application form. Fill in the necessary details, including the loan amount, repayment term, and preferred repayment method.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

Provide Required Documentation: Depending on FairKash+’s requirements, you might need to provide certain documents like proof of identity and bank account information. Ensure the information provided is accurate.

-

Approval Process: Once you submit the application and required documents, FairKash+’s system will initiate a quick loan approval process.

-

Accept Loan Terms: If your loan application is approved, FairKash+ will send you the loan terms and agreement. Before accepting the loan, carefully review the contract terms, including the interest rate, repayment schedule, and other relevant terms.

-

Loan Disbursement: Upon accepting the loan terms and signing the contract, the loan amount will be swiftly transferred to your designated bank account.

In conclusion, Kenya’s financial landscape has been transformed by the emergence of legit loan apps, making it easier for individuals to access funds for their needs. Among these, FairKash+ stands out as a trusted platform that offers a streamlined lending experience and prioritizes borrower security. However, it’s essential to exercise caution and choose loan apps that adhere to responsible lending practices, transparent terms, and data privacy protection. By selecting reputable loan apps, individuals can navigate their financial challenges with confidence and peace of mind.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status