What are the basics of personal loans?

Erick Yang

September 13, 2023

Personal loans are a common financial instrument that provides individuals with financial support for various personal needs such as buying a house, education expenses, medical bills, car purchases, and more. With personal loans, borrowers can access the necessary funds and then repay them according to agreed-upon conditions and schedules. In this article, we will delve into the basic principles of personal loans and explore a potential new loan product called FairKash+.

The Basic Principles of Personal Loans

The basic principles of personal loans are relatively straightforward, but they involve various financial and legal intricacies in practical applications. Here are the core principles of personal loans:

-

Borrower Applies for a Loan: The personal loan process begins with the borrower’s application. Borrowers need to submit an application to a bank, financial institution, or online lending platform, providing detailed personal information, financial status, and the purpose of the loan.

-

Credit Assessment and Approval: Lenders assess the borrower’s credit history to determine their credit risk. This typically includes reviewing credit reports, credit scores, and debt obligations. If the borrower has good credit, the loan application may be approved.

-

Loan Terms: Once approved, the lender provides the borrower with loan terms, including the loan amount, interest rate, repayment term, and repayment method. These terms are usually customized based on the borrower’s creditworthiness and financial situation.

-

Contract Signing: Borrowers are required to sign a loan agreement, committing to repay the loan according to the agreed-upon terms and schedule. The contract typically details the terms and conditions of the loan, as well as potential consequences and fees.

-

Disbursement of Funds: Once the contract is signed, the lender disburses the required funds to the borrower. These funds can be used for various purposes, depending on the borrower’s needs.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

Repayment: Borrowers need to make repayments according to the agreed-upon repayment plan. Repayments typically include both the principal amount and interest and can be in the form of regular installment payments or a lump-sum payment.

-

Loan Termination: Once the borrower fully repays the loan according to the contract, the loan is terminated. This means that the borrower is no longer obligated to make repayments, and the lender no longer has the right to demand repayment.

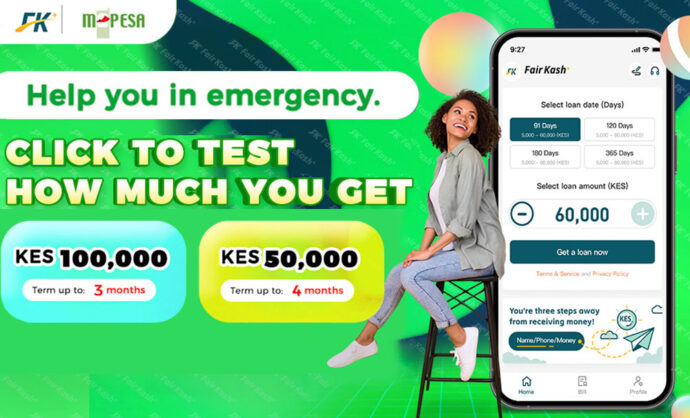

FairKash+: A New Type of Personal Loan Product

FairKash+ is a potential new type of personal loan product that introduces some new concepts based on the traditional principles of personal loans. Here is some key information about FairKash+:

-

Fair Rate Pricing: FairKash+ aims to provide fair loan interest rates. It utilizes advanced risk assessment technology that considers not only credit history but also the borrower’s overall financial situation, employment status, and repayment ability. This helps ensure that borrowers receive more competitive loan rates.

-

Social Responsibility: FairKash+ places an emphasis on social responsibility, striving to offer affordable loan products to help individuals achieve their financial goals. It may offer more flexible repayment options to accommodate diverse borrower needs.

-

Digital Experience: FairKash+ typically offers its services through online platforms or mobile applications, making it easy for borrowers to apply for loans, manage their loans, and track their progress. This enhances the customer experience and streamlines the loan process.

-

Education and Transparency: FairKash+ focuses on customer education and transparency. It may provide clear information about loan terms and repayment, helping borrowers make informed financial decisions.

-

Sustainability: FairKash+ may prioritize environmental and social sustainability and may take measures to reduce its environmental footprint and support social responsibility initiatives.

In conclusion, personal loans are a significant financial tool that allows individuals to meet various personal and household needs. Understanding the basic principles of personal loans is wise to make informed financial decisions. Meanwhile, new types of personal loan products like FairKash+ may offer borrowers more choices and competitive terms to meet their financial needs. Regardless of the loan product chosen, borrowers should exercise caution, read contracts carefully, and ensure they can make repayments on time to avoid unnecessary financial risks.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status