How to Appy for Mobile Loans in Kenya?

Erick Yang

August 15, 2023

How to Apply for Mobile Loans in Kenya

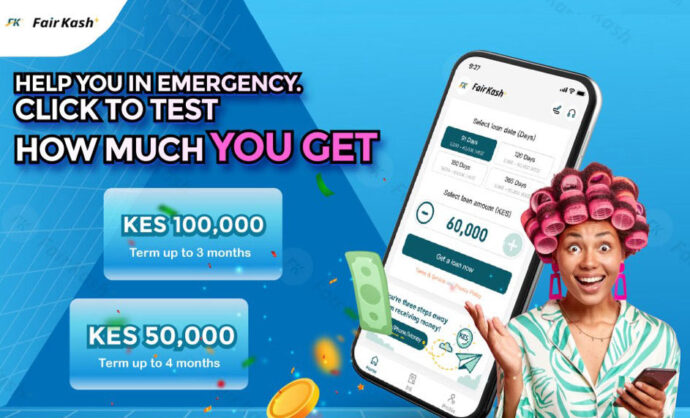

In Kenya, accessing quick and convenient loans has become easier than ever, thanks to innovative mobile loan platforms like FairKash+. These platforms allow individuals to apply for loans directly from their smartphones, eliminating the need for lengthy paperwork and traditional banking procedures. If you’re looking to secure a mobile loan in Kenya, here’s a step-by-step guide on how to use FairKash+:

Step 1: Download the FairKash+ App

Begin by downloading the FairKash+ mobile app from your device’s app store. It’s available for both Android platforms. Once downloaded, install the app and open it to proceed with the loan application process.

Step 2: Create an Account

Upon launching the app, you’ll need to create an account. This typically involves providing your basic personal information, such as your name, phone number, and email address. Creating an account will enable you to access the loan application form and other features within the app.

Step 3: Fill Out the Loan Application Form

Inside the FairKash+ app, you’ll find a loan application form. This form will require you to provide details about the loan amount you’re seeking, the repayment period you prefer, and any other necessary information. Make sure to provide accurate and up-to-date information to avoid any delays in the loan approval process.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

Step 4: Submit Required Documents

In some cases, FairKash+ might request additional documents to verify your identity and financial stability. These documents can include your national ID, passport, or other relevant identification documents. Scan or take clear photos of the documents and upload them securely through the app.

Step 5: Loan Evaluation and Approval

Once you’ve submitted your application and documents, FairKash+ will initiate the loan evaluation process. The platform uses advanced algorithms and data analysis to assess your creditworthiness and determine the loan amount you qualify for. This process is usually quick and efficient, enabling you to receive loan approval within a short period.

Step 6: Accept Loan Terms

If your loan application is approved, FairKash+ will provide you with the loan terms and conditions. Carefully review these terms, including the interest rate, repayment schedule, and any associated fees. If you agree to the terms, proceed to accept the loan offer within the app.

Step 7: Receive Funds

Upon accepting the loan offer, the approved loan amount will be disbursed to your designated bank account. This transfer is typically processed swiftly, allowing you to access the funds for your financial needs.

Step 8: Repayment

Repayment is a crucial aspect of the loan process. FairKash+ offers various repayment methods, including direct bank transfers, mobile money platforms, and automatic deductions. Choose the repayment method that suits you best and ensure timely repayments to maintain a positive borrowing experience.

In conclusion, FairKash+ offers Kenyan individuals a convenient and accessible way to apply for mobile loans. By following these steps, you can navigate the application process seamlessly and access the funds you need for various purposes. Just remember to borrow responsibly, evaluate your repayment capacity, and use the loan for genuine financial needs.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status