Which institution approves personal loans quickly?

Erick Yang

August 11, 2023

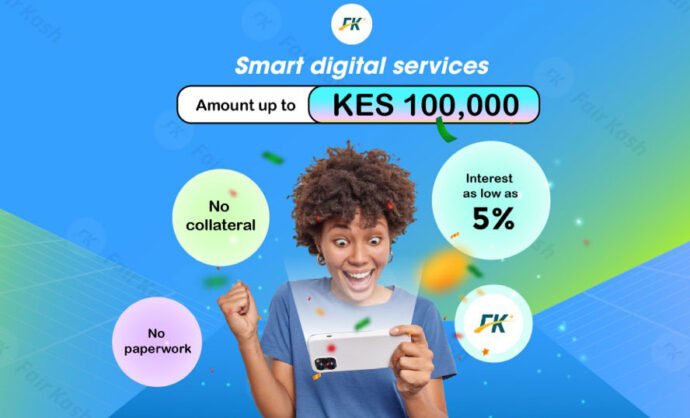

In today’s society, personal loans have become one of the important ways for many people to meet their urgent financial needs and achieve their personal goals. However, many people may find it difficult to know which institution can approve personal loans quickly. In this article, we will introduce an organization that may be your best choice-Fairkash+.

Focus on quick approval

As a leading online loan platform, Fairkash+ is famous for its dedicated and fast approval process. Compared with traditional banks or other financial institutions, the approval time of Fairkash+ is usually shorter, so that you can get the funds you need in time in an emergency.

Simplified application process

Fairkash+ also provides a simplified loan application process. You just need to download the Fairkash+ application on your mobile device, fill in the necessary personal information and loan requirements, and then submit the application. Compared with the tedious traditional application process, the application process of Fairkash+ is simpler, saving you precious time and energy.

Flexible loan terms

Fairkash+ is committed to providing flexible loan conditions for borrowers with different backgrounds. Whether you are a wage earner, a self-employed person or other sources of income, you may get a personal loan as long as you meet their requirements. This flexibility enables more people to enjoy the fast loan service provided by Fairkash+.

Quick loan

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

Once your loan application is approved, Fairkash+ will quickly transfer the loan amount to your designated bank account. This means that you can get the funds you need within the same day to solve the urgent funding needs.

How to apply for a Fairkash+ loan?

1. Download the application: download the Fairkash+ application on the mobile device.

2. Register an account: simply register and provide necessary personal information.

3. Fill in the loan application: Fill in the loan application form, including the loan amount and other information.

4. Submit the application: After submitting the application, Fairkash+ will quickly evaluate and approve it.

5. Get funds: If the loan application is approved, you will get the funds you need in a short time.

Which institution approves personal loans quickly? The answer may be those institutions that focus on quick approval process and provide simplified application process. Fairkash+, as a worthy choice, may provide you with the opportunity to quickly solve the urgent fund demand with its fast approval and loan process and flexible loan conditions. Before applying for a loan, please make sure that you understand and agree to the loan terms, so as to repay the loan on time in the future and avoid unnecessary debts and risks.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status