Why do people apply for a quick loan?

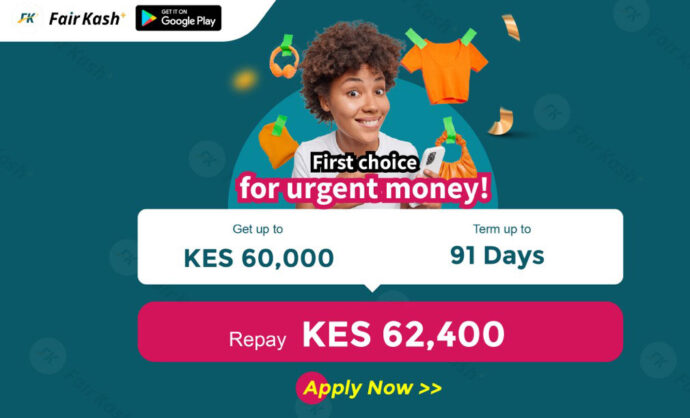

People apply for quick loans for various reasons, and FairKash+ is a platform that understands and caters to these diverse financial needs. In this article, we will explore the common reasons why individuals seek quick loans and how FairKash+ can help meet those needs.

Why People Apply for Quick Loans

-

Emergency Expenses: One of the primary reasons people apply for quick loans is to cover unexpected and urgent expenses. This could include medical bills, car repairs, home maintenance, or sudden travel expenses. Quick loans offer a fast solution to address these financial emergencies.

-

Debt Consolidation: Some individuals opt for quick loans to consolidate multiple debts into one. By doing so, they can simplify their finances and potentially secure a lower interest rate, reducing the overall cost of their debt.

-

Opportunity Seizing: Opportunities that require immediate financial investment, such as a limited-time business opportunity or a significant purchase at a discount, may prompt people to seek quick loans. They want to take advantage of these opportunities before they pass.

-

Home Improvements: Home renovations or repairs are common reasons for seeking quick loans. These projects can enhance the quality of life and the value of a property, making them a worthwhile investment.

-

Education Expenses: Many individuals apply for quick loans to cover education-related costs, such as tuition fees, textbooks, or educational equipment. This allows them to pursue personal or career development goals.

-

Celebrations and Events: Special occasions like weddings, graduations, or milestone birthdays often come with significant expenses. Quick loans can help individuals plan and celebrate these events without financial stress.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

Cash Flow Gaps: Sometimes, people experience temporary cash flow gaps due to irregular income or unexpected expenses. Quick loans can bridge these gaps and help maintain financial stability.

-

Business Needs: Entrepreneurs and small business owners may require quick loans to fund their businesses’ working capital, purchase inventory, or invest in growth opportunities.

-

Credit Score Improvement: Borrowing and responsibly repaying a quick loan can positively impact an individual’s credit score. This can be a motivation for some borrowers, as it improves their overall financial health.

How FairKash+ Can Help

FairKash+ is a versatile lending platform that understands the diverse financial needs of its users. Here’s how FairKash+ can help individuals seeking quick loans:

-

Quick and Convenient Application: FairKash+ streamlines the loan application process, making it fast and hassle-free. Users can apply online or through the mobile app, ensuring they get the funds they need when they need them.

-

Transparent Terms: FairKash+ provides clear and transparent loan terms and conditions. Borrowers can review all the details, including interest rates, repayment schedules, and any associated fees, before accepting the loan offer.

-

Varied Loan Options: FairKash+ offers various loan types to cater to different financial needs. Users can choose the loan product that best suits their specific requirements.

-

Flexible Repayment Plans: FairKash+ understands that every borrower is unique. It offers flexible repayment plans that align with a borrower’s financial capacity, making it easier to manage and repay the loan.

-

Credit Building: Responsible borrowing and timely repayment of loans with FairKash+ can help users build or improve their credit scores, enabling them to access more financial opportunities in the future.

In conclusion, people apply for quick loans for a multitude of reasons, from unexpected emergencies to seizing opportunities or achieving personal goals. FairKash+ provides a user-friendly and responsive platform that meets these diverse needs, ensuring that individuals can access the financial assistance they require swiftly and efficiently. Whether it’s covering an unexpected expense or pursuing an exciting opportunity, FairKash+ is there to support its users in their financial journey.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status