What are the application conditions for online loans to M-Pesa?

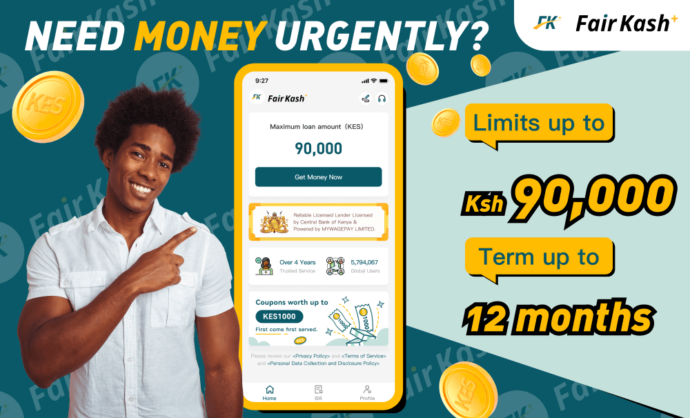

FairKash+ offers online loans to M-Pesa for individuals in need of fast and convenient loan solutions. This loan option provides greater flexibility through M-Pesa but still requires meeting certain eligibility criteria. Here are the general eligibility requirements for FairKash+ online loans to M-Pesa:

1. Age Requirement: Typically, applicants must be 18 years or older. This is because minors cannot enter into legal contracts, and loan companies require borrowers to be of legal age.

2. Identity Verification: You need to provide valid identification documents to confirm your identity. This usually includes a national ID card, passport, or driver’s license. These documents are used to verify your name and date of birth.

3. M-Pesa Account: You must have a valid M-Pesa account as online loans will be transferred and repaid through M-Pesa. Ensure your M-Pesa account is active and has undergone Know Your Customer (KYC) verification.

4. Mobile Phone Number: Typically, you need to have a valid mobile phone number that is registered and linked to your M-Pesa account. This is because M-Pesa accounts are identified and managed through phone numbers.

5. Proof of Income: You need to provide information about your financial situation, including your sources of income. This can include pay stubs, employer verification, or other relevant financial documents.

6. Credit History: While online loans to M-Pesa usually do not require an excellent credit history, some loan companies may conduct a basic credit check. This is to assess your credit risk and repayment capacity.

7. Address Verification: You need to provide your residential address for verification. This can typically be done through a utility bill, rental agreement, or similar documents.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

8. Loan Purpose: In some cases, loan companies may require information about the purpose of the loan. This helps ensure that you’re using the loan funds for legitimate and reasonable needs.

9. Legal Residency: You should be a legal resident of the area where the loan company offers its services.

Please note that different loan companies may have varying application requirements, so be sure to review and understand their specific criteria when choosing a lending platform. Additionally, borrowers should exercise caution when taking out loans, borrowing only what they can afford, and repaying on time to maintain their credit history.

In summary, FairKash+ online loans to M-Pesa provide a convenient solution for those in need of emergency funds, as long as the basic requirements mentioned above are met.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status