What is the process for help loan application?

Erick Yang

October 16, 2023

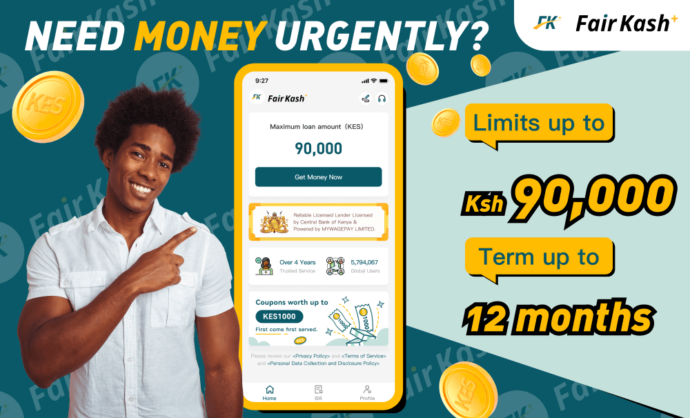

The process of help loan application at FairKash+ is a crucial service that can make it easier for borrowers to access the funds they need. At FairKash+, this process is designed to be straightforward, ensuring that borrowers can quickly and conveniently obtain loan assistance. Here is detailed information about the process of applying for loan assistance at FairKash+:

1. Visit the FairKash+ Platform: The first step is to visit FairKash+’s official website or download their mobile application. This provides you with access to their loan assistance services.

2. Register or Log In: If you are an existing FairKash+ user, simply log in to your account. If you are a new user, you’ll need to create an account, provide basic information, and create a secure login credential.

3. Fill Out the Loan Application: Within your FairKash+ account, you will find a user-friendly online application form. When filling out this form, you’ll need to provide detailed information about your personal information, financial situation, and the specific loan you require.

4. Choose a Loan Product: FairKash+ offers various loan products, including short-term loans, personal loans, and small loans. You can select the loan product that best suits your needs.

5. Submit the Application: Once you have completed the loan application form, simply click the “Submit” button, and your application will be forwarded to FairKash+’s loan team for approval.

6. Approval Process: Upon receiving your loan application, FairKash+ will swiftly process it. Their automated system will verify your information, typically completing the approval process within a few minutes. If necessary, they may contact you for additional information or documentation.

7. Loan Approval: Once your loan application is approved, you will receive the funds immediately in the bank account you provided. This means you can address urgent financial needs in a short amount of time.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

8. Repayment Arrangements: Depending on the loan product you choose, FairKash+ will work with you to establish a repayment plan. You will need to repay on time according to the contract-specified repayment dates and amounts.

9. Stay in Touch with FairKash+ Regularly: You can contact FairKash+’s customer support team at any time for assistance with repayment, account management, or other related matters.

In summary, the process of applying for loan assistance at FairKash+ is rapid, convenient, and transparent. They are committed to ensuring that borrowers can easily access the funds they need while providing professional support and guidance to ensure a smooth loan process. This makes FairKash+ a preferred choice for many individuals when facing urgent financial needs.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status