Will I check my credit if I borrow money from FairKash+?

Erick Yang

September 4, 2023

FairKash+ and Credit Checks: Understanding Your Loan Application

When applying for a loan, many borrowers are concerned about the possibility of a credit check affecting their financial standing. Credit checks are a common practice used by loan providers to assess a borrower’s credit history and credit score, determining whether to approve a loan application and set the loan terms. FairKash+ is an online loan provider in Kenya, committed to offering fast, transparent, and efficient loan services to borrowers. This article delves into whether FairKash+ conducts credit checks and how to understand the impact of this process on borrowers.

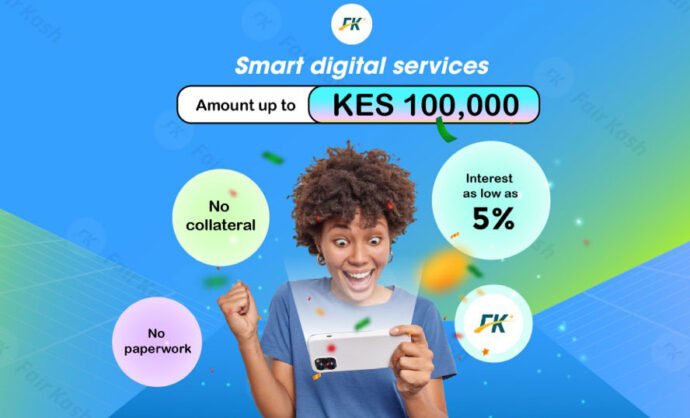

FairKash+: Kenya’s Online Loan Provider

FairKash+ is an online loan provider in Kenya, specializing in offering fast, convenient loan services to individuals and businesses. The company is renowned for its excellent customer service and transparent loan terms, making it a significant player in Kenya’s online loan market.

Credit Checks and Loan Applications

Credit checks are a common practice used by loan providers to evaluate a borrower’s credit history and credit score. They aim to determine a borrower’s credit risk to establish suitable loan terms. Credit checks typically encompass several aspects:

-

Credit History: Credit checks review a borrower’s credit history, including past loan and credit card repayment records. This helps determine whether borrowers have a history of making timely repayments.

-

Credit Score: Credit scores are calculated based on a borrower’s credit history and other factors. They are often used to gauge a person’s credit health and, subsequently, whether to approve a loan.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

Debt Situation: Loan providers also consider a borrower’s current debt situation, including other outstanding loans and credit card debts.

-

Income Situation: A borrower’s income level is also part of the credit check, as it relates to whether borrowers have sufficient income to repay the loan.

FairKash+ and Credit Checks

FairKash+ typically conducts credit checks, but the manner and extent of these checks may vary. Here is some important information about credit checks by FairKash+:

-

Soft and Hard Inquiries: Loan providers can conduct soft or hard inquiries. Soft inquiries are typically used for pre-screening loan applications and do not have an adverse impact on credit records. Hard inquiries are usually conducted after loan approval and appear on credit reports, potentially affecting credit scores.

-

Credit Score Requirements: FairKash+ may have certain credit score requirements to ensure that borrowers have a sufficient level of credit health to take on the loan.

-

Flexible Review: While FairKash+ may conduct credit checks, it also typically considers borrowers’ overall financial situations. This means that even if your credit score is lower, if your income and debt situation are favorable, you may still be approved for a loan.

Impact of Credit Checks on Borrowers

Credit checks have a certain impact on borrowers’ credit records and loan applications, but this impact is usually temporary. Here are some key points about the impact of credit checks on borrowers:

-

Short-Term Impact: Hard inquiries (typically used for loan approval) may have a short-term impact on credit records, but this impact usually dissipates within a few months.

-

Credit Score Reduction: Hard inquiries may lead to a reduction in credit scores, but this reduction is typically limited and gradually recovers over time.

-

Loan Opportunities: Credit checks help loan providers assess borrowers’ credit risks, ensuring that borrowers can manage the loan responsibly.

How to Improve Loan Application Success

To increase the chances of a successful loan application, borrowers can consider the following measures:

-

Maintain a Good Credit History: Making timely repayments and avoiding late payments can help maintain a positive credit history.

-

Improve Credit Scores: Enhancing credit scores can increase the likelihood of loan approval. This includes reducing credit card debt, minimizing outstanding loans, and building a longer credit history.

-

Select Appropriate Loans: Choosing loans that align with your financial situation and ensuring you can make repayments on time is crucial.

-

Consult Loan Experts: If your credit situation is poor or you are unsure about loan approval, consulting loan experts or financial advisors can provide guidance on improving your credit health and increasing your chances of approval.

In conclusion, when applying for a loan, it’s important to understand that credit checks are a standard part of the process. While they may have a temporary impact on your credit record, they are typically a necessary step to ensure responsible lending. FairKash+ conducts credit checks but also takes a flexible approach, considering borrowers’ overall financial situations. Borrowers can take steps to improve their credit health and financial stability to enhance their chances of successful loan applications.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status