What are the advantages of online Kenyan loans compared with traditional bank loans?

Loan has become a convenient and fast financial service mode. Compared with traditional bank loans, online Kenyan loans have many advantages. This paper will compare the loan process, loan application, loan interest rate and repayment method to show the advantages of online Kenyan loans.

First of all, the application process of online Kenya loan is simpler and faster. The borrower only needs to fill in personal information and loan purpose on the loan platform, and upload relevant supporting documents to complete the loan application. In contrast, traditional bank loans require borrowers to provide a large number of documents and certificates, and go through complicated procedures and processes. In addition, the online loan review process is faster and can generally be completed within a few working days.

Secondly, the loan interest rate of online Kenyan loans is low. Because online lending platforms have lower operating costs and higher risk control capabilities, they can provide more favorable loan interest rates. In contrast, the interest rate of traditional bank loans is usually higher, because they need to bear higher labor and operating costs and more risks.

In terms of repayment methods, online Kenyan loans are more flexible and diverse. According to the borrower’s needs, the repayment period and repayment method can be customized.

In addition, online Kenyan loans are more transparent and secure. On the loan platform, borrowers can check their account information, repayment plans and repayment records at any time to ensure the transparency and security of loans. At the same time, the loan platform also has stronger risk control ability, which can effectively avoid the occurrence of non-performing loans and bad debts.

To sum up, online Kenyan loans have more advantages than traditional bank loans. It not only has simple and fast application process, low loan interest rate, more flexible and diverse repayment methods, but also has higher transparency and security. Therefore, for borrowers who need loans, choosing online Kenyan loans is a more convenient, efficient and safe choice.

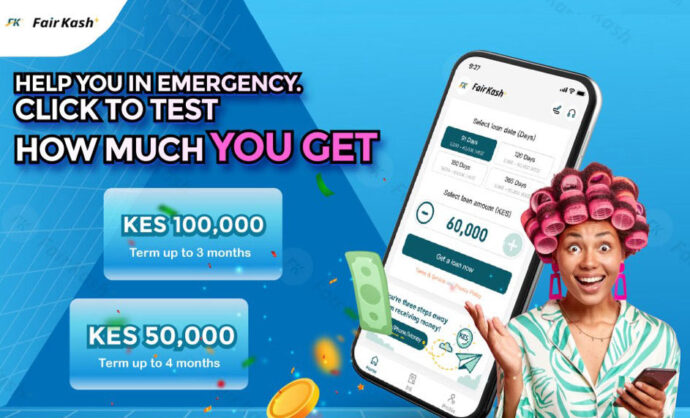

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status