What emergencies are quick online mpesa loans suitable for?

Understanding Emergencies Suitable for Quick Online M-Pesa Loans

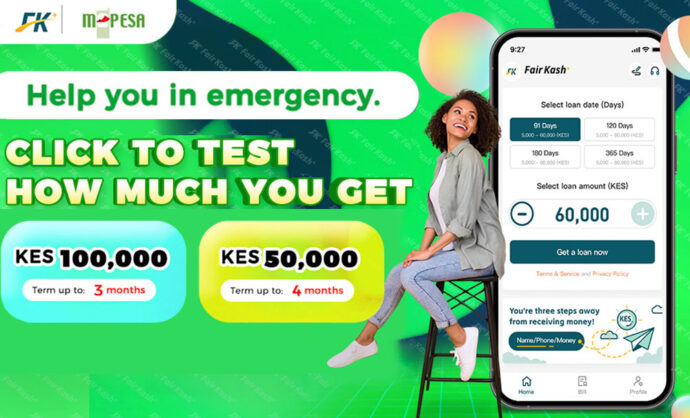

Quick online M-Pesa loans serve as a convenient financial lifeline during unforeseen emergencies, providing swift access to funds. These loans are particularly well-suited for addressing urgent financial needs, including:

1. Medical Emergencies:

-

Unexpected medical expenses, hospital bills, or urgent treatments often require immediate funds. Quick online M-Pesa loans can cover such emergency medical costs, ensuring timely access to healthcare.

2. Unforeseen Car Repairs:

-

Vehicle breakdowns or repairs are unforeseen and might disrupt daily life. Accessing quick funds through online M-Pesa loans can help cover these repair costs swiftly, ensuring your vehicle is back on the road.

3. Home Repair and Maintenance:

-

Sudden home repairs like plumbing issues, electrical problems, or structural damages may necessitate immediate attention. Quick loans provide the necessary funds to address these home emergencies promptly.

4. Unexpected Travel Expenses:

-

Urgent travel due to family emergencies, funerals, or unforeseen work-related trips may require immediate financing. Quick online M-Pesa loans enable individuals to cover travel expenses promptly.

5. Education-Related Expenses:

-

Immediate educational expenses, such as tuition fees, books, or course materials, might arise unexpectedly. These loans can bridge the gap, ensuring continuity in education.

6. Utility Bill Payments:

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

Overdue utility bills or unforeseen high bills can cause financial strain. Quick loans can assist in settling such bills to avoid service disruptions.

7. Small Business Needs:

-

Small business owners might encounter immediate capital needs for inventory, equipment repairs, or addressing unforeseen operational challenges. Quick loans offer timely financial support.

8. Debt Consolidation in Emergencies:

-

In critical situations where multiple debts or high-interest loans become unmanageable, a quick loan can help consolidate debts, providing relief and a more structured repayment plan.

9. Unexpected Job Loss or Income Gaps:

-

During unexpected job loss or gaps between incomes, quick loans can serve as a temporary financial cushion to cover essential expenses until stability is regained.

Conclusion: Quick online M-Pesa loans cater to a range of unforeseen emergencies, providing immediate financial relief. They offer a convenient and accessible solution for addressing urgent financial needs, ensuring individuals can navigate through unexpected situations without undue financial stress.

However, it’s essential to use these loans responsibly and consider repayment capabilities to avoid further financial strain.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status