Could I get a personal loan with an 800 credit score?

Erick Yang

October 18, 2023

An 800 credit score is an impressive financial achievement that places you in the category of “exceptional credit.” With such a high credit score, you have demonstrated a history of responsible financial management and a strong ability to handle debt. But can you get a personal loan with an 800 credit score, and if so, what are your options? In this article, we will delve into the possibilities available to individuals with an 800 credit score.

1. Traditional Lenders: With an 800 credit score, you are likely to be welcomed with open arms by traditional lenders, such as banks and credit unions. They typically offer personal loans with competitive interest rates and favorable terms, making it easier to secure the funding you need.

2. Online Lenders: Online lenders also cater to borrowers with excellent credit. They often provide a convenient and swift application process, allowing you to access your funds quickly. You can explore various online lending platforms to compare offers and find the best deal.

3. Credit Unions: Credit unions are known for their personalized service and may offer lower interest rates on personal loans compared to some banks. With an 800 credit score, credit unions are an excellent choice, and they often consider factors beyond your credit score when making lending decisions.

4. Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers with individual investors. While you might not get the same loan amounts as traditional lenders, you can often secure a personal loan at competitive rates, especially with an 800 credit score.

5. Credit Cards: If you need a smaller amount of money for a short-term expense, consider using a credit card. With an 800 credit score, you’re likely to qualify for some of the best credit card offers, including cards with 0% introductory APR on purchases.

6. Home Equity Line of Credit (HELOC): If you own a home and have equity built up, you might consider a HELOC. The interest rates on HELOCs are generally lower than other forms of credit, and you can use the funds for various purposes.

7. Explore Loan Types: With a strong credit score, you have the flexibility to choose between different loan types. These may include unsecured personal loans, secured personal loans, debt consolidation loans, and more. Your choice will depend on your specific financial goals and needs.

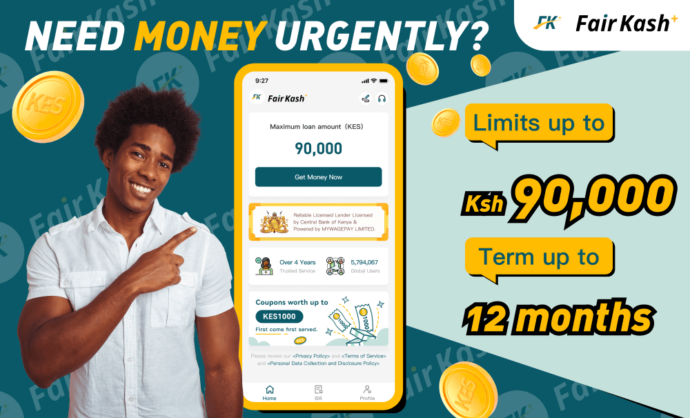

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

8. Compare Offers: It’s essential to shop around and compare loan offers from various lenders. Even with an 800 credit score, terms and conditions can vary. By comparing offers, you can ensure you get the most favorable deal.

9. Employment and Income: Lenders often look at your income and employment stability, even with a high credit score. Having a steady job and a sufficient income will further strengthen your loan application.

10. Maintain Financial Responsibility: While a high credit score is a significant asset, maintaining your financial responsibility is key. Continue to pay your bills on time and manage your credit wisely, as this will help you maintain your excellent credit standing.

In conclusion, having an 800 credit score provides you with a plethora of personal loan options. Traditional lenders, online lenders, and other financial institutions are eager to work with borrowers who have demonstrated financial responsibility. With your exceptional credit score, you have the advantage of choosing the loan that best fits your needs and enjoying favorable terms and interest rates.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status